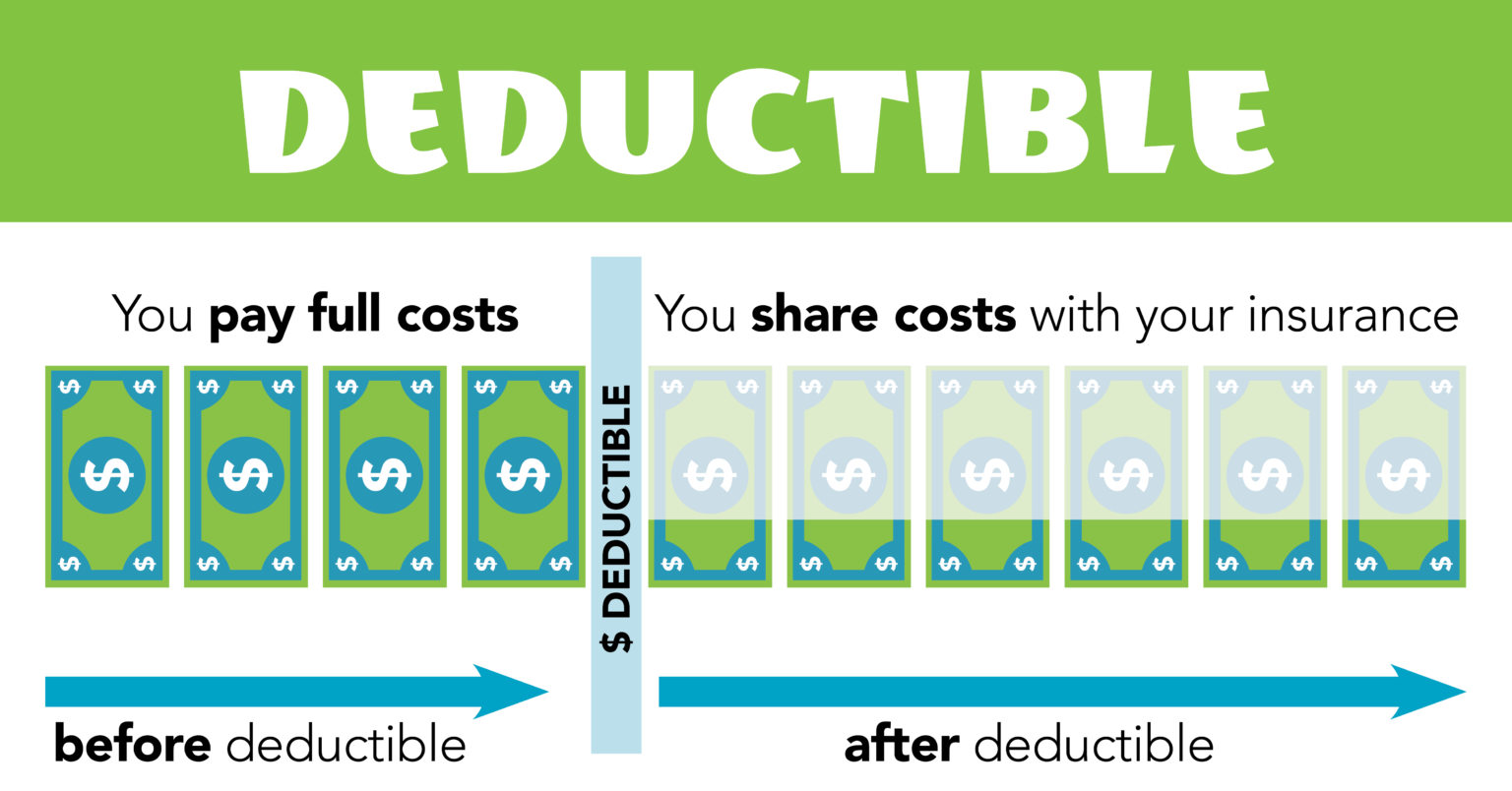

Ghi 2025 Deductible Medical - Medicare Hospital Deductible 2025 Abbe Lindsy, Here's what you need to know. Ghi 2025 Deductible Medical. The threshold for medical expense deductions has always been a moving target, subject to periodic adjustments and legislative tweaks. According to irs publication 502, you can only classify services or items as medical expenses if they “alleviate or prevent a physical or mental disability or illness.” below are 99 medication expenses you may be able to.

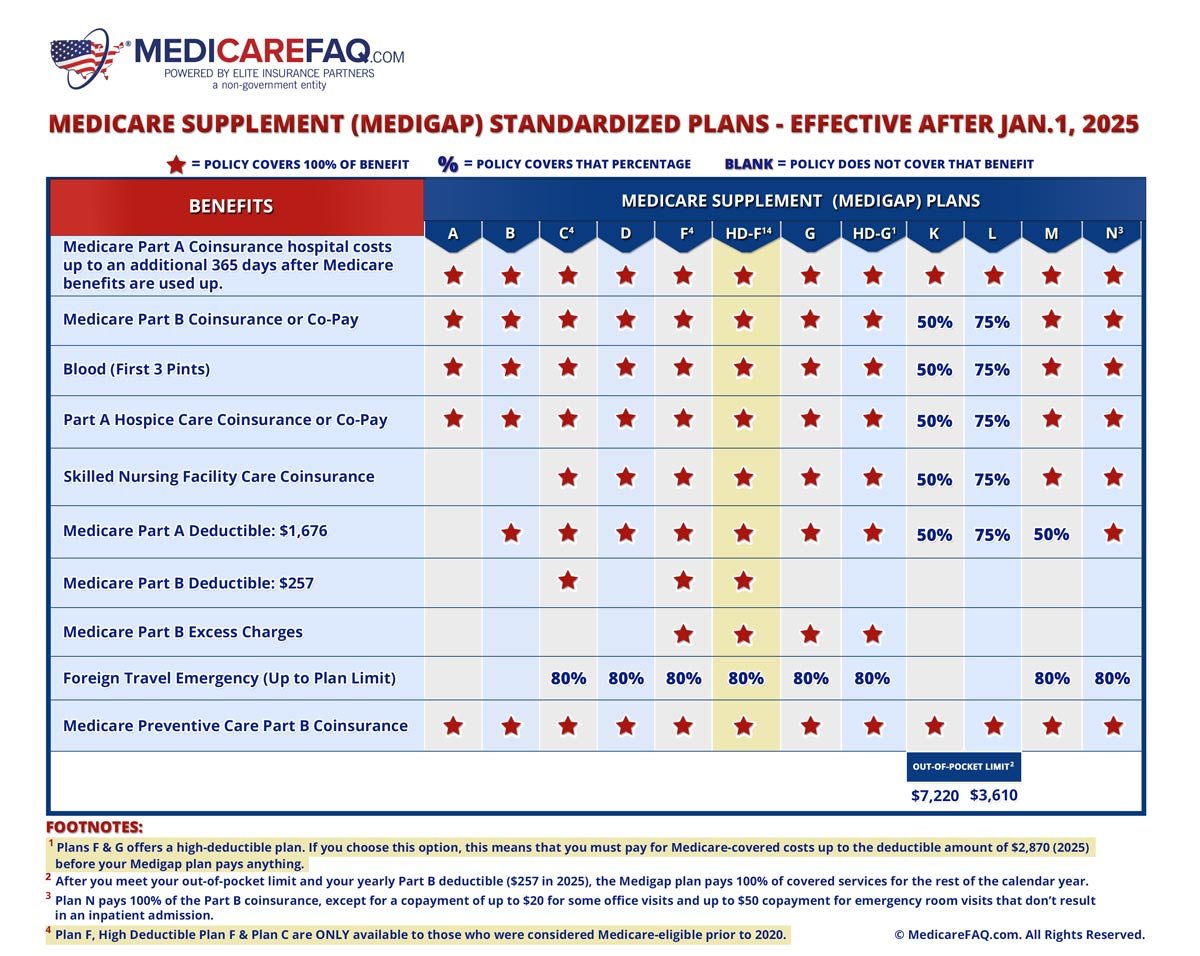

Medicare Hospital Deductible 2025 Abbe Lindsy, Here's what you need to know.

What Is Part A Deductible For 2025 Image to u, Medical expenses include dental expenses, and in this publication the term “medical expenses” is often used to refer to medical and dental expenses.

How Much Is Medicare Deductible For 2025 Anthe Jennilee, Medical and dental expenses can add up quickly.

Driving Change from the Ground Up A Series of Success Stories in, To receive a tax benefit, you have to itemize deductions on schedule a.

Taxpayers who itemize on schedule a can continue to deduct qualifying medical expenses to the extent that the total amount exceeds 7.5% of adjusted gross income. Fy2025 sc medical enrollment/cos form.

What Is The Deductible For Medicare In 2025 Lory Silvia, Taxpayers who itemize on schedule a can continue to deduct qualifying medical expenses to the extent that the total amount exceeds 7.5% of adjusted gross income.

Medicare 2025 Deductible Alika Beatrix, We’ll explore how these thresholds might shift in.

Medicare Plan A Deductible 2025 Pdf Cathee Katerina, If you’ve incurred substantial medical or dental costs in 2025, you may be eligible to claim deductions that can help lower your taxable income and potentially lead to a tax refund.

2025 Deductible Limits Yetty Madelene, According to irs publication 502, you can only classify services or items as medical expenses if they “alleviate or prevent a physical or mental disability or illness.” below are 99 medication expenses you may be able to.

Deductible Medical Expenses 2025 Emmie Isadora, To receive a tax benefit, you have to itemize deductions on schedule a.